According to World Bank data, Vietnam ranks 8th among the top 10 countries investing in renewable energy in the world, with a total capital reaching USD 7.4 billion. With abundant solar energy and wind energy resources, Vietnam is one of the countries with the greatest potential for green transformation in the Southeast Asia region.

Apart from factors such as geography and natural resources, the growth of green investment in Vietnam is also due to attractive investment incentive policies, not only helping to protect the environment but also attracting many domestic and international investors.

Article 134 of Decree No. 08/2022/NĐ-CP stipulates that enterprises engaging in the production, supply of technology, equipment, products, and services to meet environmental protection requirements, including waste treatment technology, renewable energy production, etc., will receive preferential treatment, support in terms of taxes, fees, and charges.

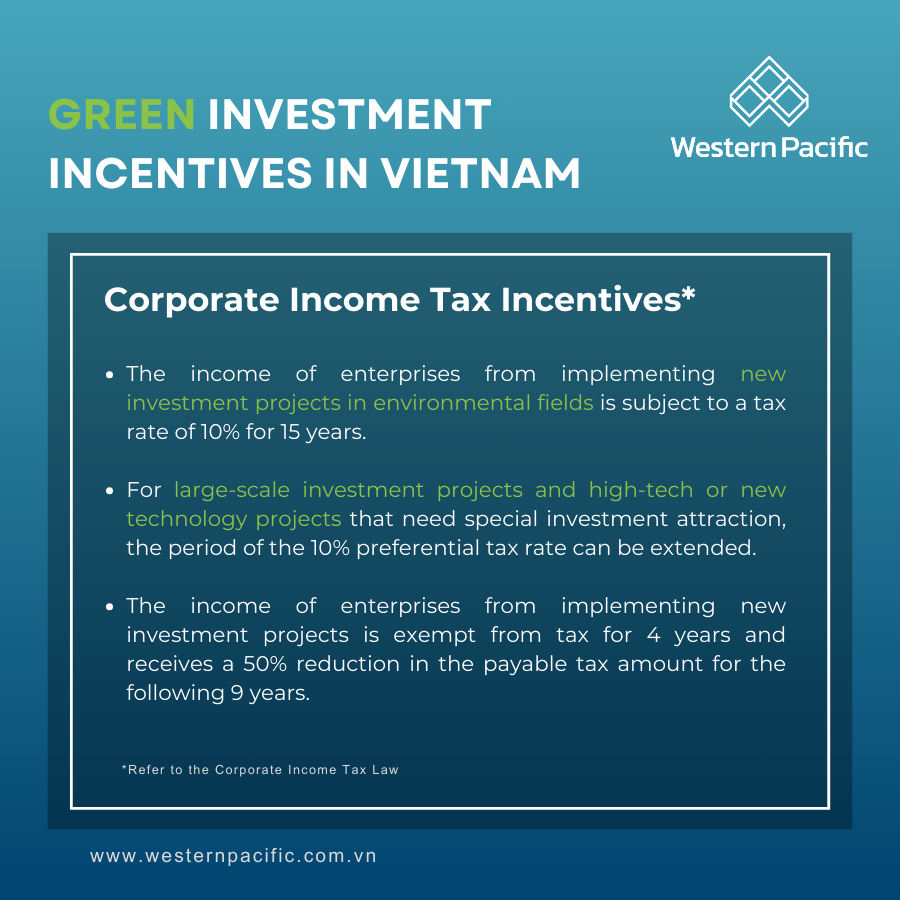

Corporate income tax incentives

- Income from implementing new investment projects in environmental sectors is subject to a 10% tax rate for 15 years. For large-scale and high-tech or new technology investment projects requiring special attraction, the period of applying the 10% preferential tax rate can be extended.

- Income from implementing new investment projects is exempt from tax for 4 years, with a 50% reduction in the tax payable for the following 9 years.

Import tax incentives

- Environment protection projects listed in the list of preferential investment sectors will be exempt from import duties on imported goods to create fixed assets, exempt from export duties on goods exported, import duties on goods imported for environmental protection.

- Import tax exemption for 5 years, starting from the commencement of production for domestically unproduced raw materials, materials, components imported for production by high-tech enterprises, scientific and technological enterprises.

Value-added tax (VAT) incentives and other benefits

- Input VAT on goods and services incurred during the cumulative investment period that has not been deducted can be refunded if certain conditions are met simultaneously (declaration method, business license/approval document for conditional investment and business activities...).

- Furthermore, some incentives and support regarding land (exemption, reduction of land use fees, land rent, land use tax), subsidies for environmental protection products and services as regulated, are also applicable.

Do you need support?

Our team of experts is always ready to support and provide customers with optimal solutions! Contact us